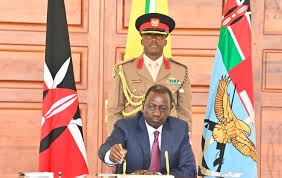

President William Ruto has defended the government’s plan to levy additional taxes on Kenyans, stating that it is part of a broader strategy to enhance the country’s revenue and reduce reliance on borrowing.

The Head of State says he intends to raise the country’s average tax rate from the current 14 percent to 16 percent by the end of this year and aims for a rate of between 20 and 22 percent by the end of his term in office.

While acknowledging the economic burden Kenyans will have to bear to achieve this target, Ruto believes that the long-term benefits will justify the increased taxes.

“My drive is to push Kenya, possibly this year we will be at 16% from 14%. I want in my term, God willing, to leave it at between 20 and 22 %. It’s going to be difficult, I have a lot of explaining to do, people will complain but I know finally they will appreciate that the money we go to borrow from the World Bank is savings from other countries,” said Ruto.

He was speaking during an engagement with the Harvard Business School’s Class of 2025 students on Africa’s trade and investment potential at State House, Nairobi on Tuesday.

President Ruto noted that the push to raise more revenue through taxes was also part of ensuring that “we live within our means.”

“When I came into office I told everybody to tighten up your belts… I am not going to preside over a bankrupt country… I’m not going to preside over a country in debt distress. We have to cut our spending. And there is no free lunch,” he said, further dismissing the perception that Kenya has higher taxes compared to the region.

“…Kenyans have been socialised to believe that they pay the highest taxes but empirical data shows that as of last year, our tax as a percentage of our revenues was 14 %. Our peers in the continent are on an average of between 22 and 25 per cent which means our taxes are way below those of our peers,” said President Ruto.

He added: “And I’m not comparing ourselves with OECD countries. Countries like France are at 45% others are higher. So I persuaded and made a case to the people of Kenya that we must begin to enhance our revenue because if we are a serious state we must be able to enhance our taxes.”

President Ruto’s remarks amid a proposal of sweeping changes to the country’s Value Added Tax (VAT) system that will see his administration raid pockets of millions of Kenyans in the cost of various commodities.

Top on the list is the increase in the price of bread and a mandatory tax for all motor vehicle owners in the country as the government funds the 2024-2025 budget

Treasury has proposed to paste VAT on bread, with a proposed rate of 16 per cent after removing bread from tax exemption.

The Finance Bill 2024 also suggests eliminating VAT exemptions for several financial services, including issuing credit and debit cards, telegraphic money transfer services, and cheque handling, processing, clearing, and settlement including special clearance or cancellation of cheques